Make Forests A Part of Your Legacy

"Planned" or "legacy" gifts are contributions of cash, equity, or land that are arranged in the present and granted at a future date, most often donated through a will or trust.

Entrusting the Foundation for Sustainable Forests with your gift will carry forward your conservation legacy and contribute to the security and resilience of this organization and its forested lands in perpetuity.

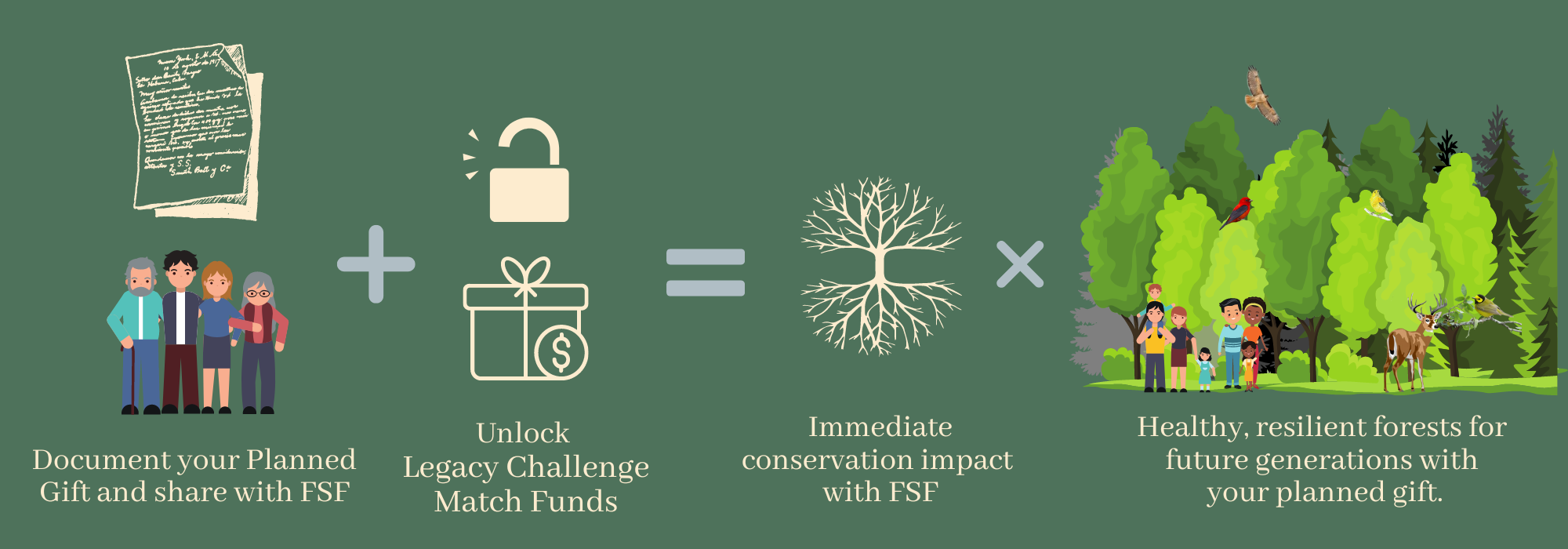

Take the Forest Legacy Planning Match Challenge!

Thanks to the generosity of Troy Firth, this limited-time challenge gives you peace of mind two ways: make a planned gift to FSF of cash or assets for the future, and you will unlock a match gift that supports FSF today!

When you make a planned gift to FSF, you are building a legacy of forest conservation and resilient landscapes that is bigger than all of us. Notify FSF of your good intentions and unlock a matching cash donation from Troy today – starting at $500!

How it works

How the Matching Gift amount is determined:

Planned gift notification with unspecified value: Our donor will make a gift of $500 to FSF in your honor.

Planned gift notification with a specified value: Our donor will match your gift at 5% up to $2,500. For example, a planned gift valued at $30,000 will unlock a match gift of $1,500 to FSF in your honor.

These matching funds are available for a limited time. Please act soon to confirm your intent to include FSF in your estate plan, and notify us before the end of 2024 in order to realize the full potential of this challenge for forest conservation!

If you have remembered The Foundation for Sustainable Forests in your will, please let us know so that we can say "Thank You" during your lifetime!

There are many ways to include forest conservation in your estate plan:

-

Name FSF in your Will or Living Trust. You can specify your bequest as a dollar amount, a percentage of your estate, or a specific asset such as real estate or securities. This approach offers flexibility to you, the donor, because your assets remain in your control during your lifetime and you can modify your bequest at any time.

-

Designate FSF as a Beneficiary of your IRA or Pension Plan. By naming the FSF as a beneficiary of your retirement assets, you are supporting the FSF's mission through a revocable commitment. In addition, your distribution of assets to a nonprofit entity can also reduce income tax liability at the time of distribution.

-

Set up a qualified charitable distribution. IRA owners who are 72 or older can make a tax-free charitable contribution from their retirement account to the Foundation for Sustainable Forests via directed donation to the Crawford Heritage Community Foundation.

-

Gifts of Real Estate. Gifts of forested land will be sustainable working woodlands in perpetuity and will directly further the mission of the Foundation for Sustainable Forests to conserve forested land in the region. Visit our Forest Conservation Planning page for more information.

To explore your Planned Giving options, please contact Annie Maloney. [email protected], (814) 694-5830

My wife Jane and I consider it an honor to be associated with the Foundation for Sustainable Forests. We could think of no better way to have part of our legacy do the most good. We are truly grateful to FSF for the important work they do.

-Bob Slagter